Transmission

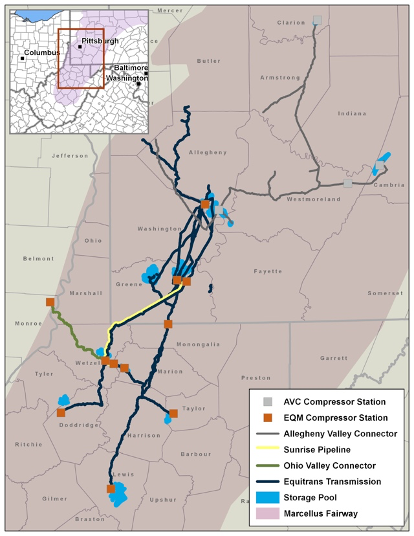

As of December 31, 2022, the transmission and storage system included approximately 940 miles of FERC-regulated, interstate pipelines that have interconnect points to seven interstate pipelines and multiple local distribution companies (LDCs). The transmission and storage system is supported by 43 compressor units, with total throughput capacity of approximately 4.4 Bcf per day and compression of approximately 136,000 horsepower, and 18 associated natural gas storage reservoirs, which have a peak withdrawal capacity of approximately 820 million cubic feet (MMcf) per day and a working gas capacity of approximately 43 Bcf.

Equitrans provides transmission and storage services in two manners: firm service and interruptible service. Firm service contracts are typically long-term and can include firm reservation fees, which are fixed, monthly charges for the guaranteed reservation of pipeline and storage capacity. Volumetric-based fees can also be charged under firm contracts for firm volume transported or stored as well as for volumes transported or stored in excess of the firm contracted volume, if there is system capacity. Customers are not assured capacity or service for volumes in excess of the firm contracted volume as such volumes have the same priority as interruptible service. At year-end 2022, and including future capacity expected from expansion projects that are not yet fully constructed, approximately 5.7 Bcf per day of transmission capacity, excluding 2.3 Bcf per day of firm capacity commitments associated with the MVP and MVP Southgate projects, and 27.8 Bcf of storage capacity were subscribed under firm transmission and firm storage contracts, respectively.

Interruptible service contracts include volumetric-based fees, which are charges for the volume of natural gas transported and generally do not guarantee access to the pipeline or storage facility. These contracts can be short- or long-term. Customers with interruptible service contracts are not assured capacity or service on the transmission and storage systems. To the extent that capacity reserved by customers with firm service contracts is not fully used or excess capacity exists, the transmission and storage systems can allocate capacity to interruptible services. The Company generally does not take title to the natural gas transported or stored for its customers.

Transmission also includes Equitrans Midstream’s investment, through EQM Midstream Partners, in the Mountain Valley Pipeline (MVP), MVP Southgate projects, and other expansion projects. See our Projects page for more information.